#3 of 5: Product info and reviews make Amazon the primary digital touch point in path to purchase

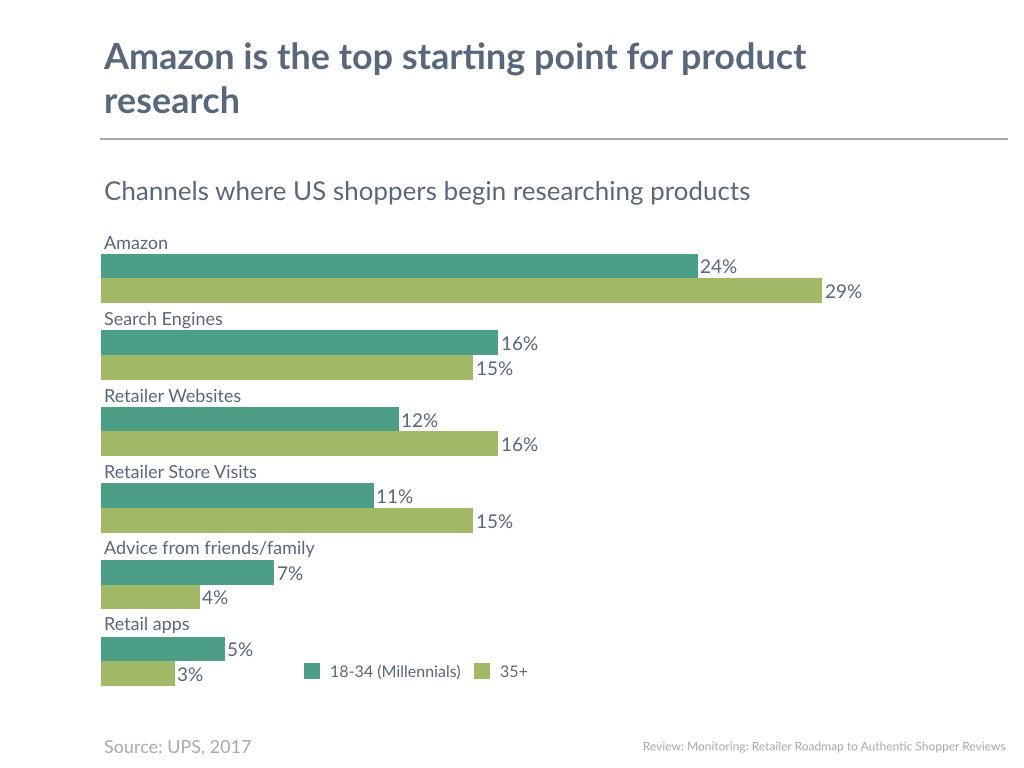

Amazon is the first and most visited online touch point among shoppers when it comes to pre-purchase research. Almost 1 in 4 (24%) of 18-34 year old Millennials shoppers and nearly 3 in 10 (29%) shoppers 35 and above say Amazon is the first site they visit when they start researching for brands and products. In comparison only 12% of Millennial shoppers and 16% of older shoppers visit retailer websites first during research.

The top three reasons people prefer to start their pre-purchase research on Amazon are access to a large variety of products (79%), free shipping options (64%), and better pricing and promotion (60%). More than half (55%) also agree that a large volume of customer reviews is one of the key reasons they visit Amazon first. In other words, Amazon is perceived as the primary destination for product reviews.

Reading product reviews is one of the two of the most popular research activities among shoppers alongside looking up product information. Amazon is the ideal website where both these actions can happen during the same visit. Among online shoppers who made an online purchase in the last three months, more than half (51%) visited Amazon product pages to get information during research. Almost 1 in 2 (48%) visited Amazon to read product reviews before making a purchase decision. The share of shoppers visiting Amazon for product information and reviews only slightly declines to 41% among shoppers who purchased an item online more than three months ago.

The only prominent touch point for retailers during research is email. More than 1 in 3 (36%) of recent shoppers opened and read an email from a retailer as part of their pre-purchase research. Shoppers do not perceive retailer websites as touch points where they can look up product information or read reviews. This makes retailer websites lose relevance as a key destination for pre-purchase research.

Amazon is removing commenting feature from product reviews