Quick takeaway: Price comparison and in-store mobile usage are key moments to generate online reviews

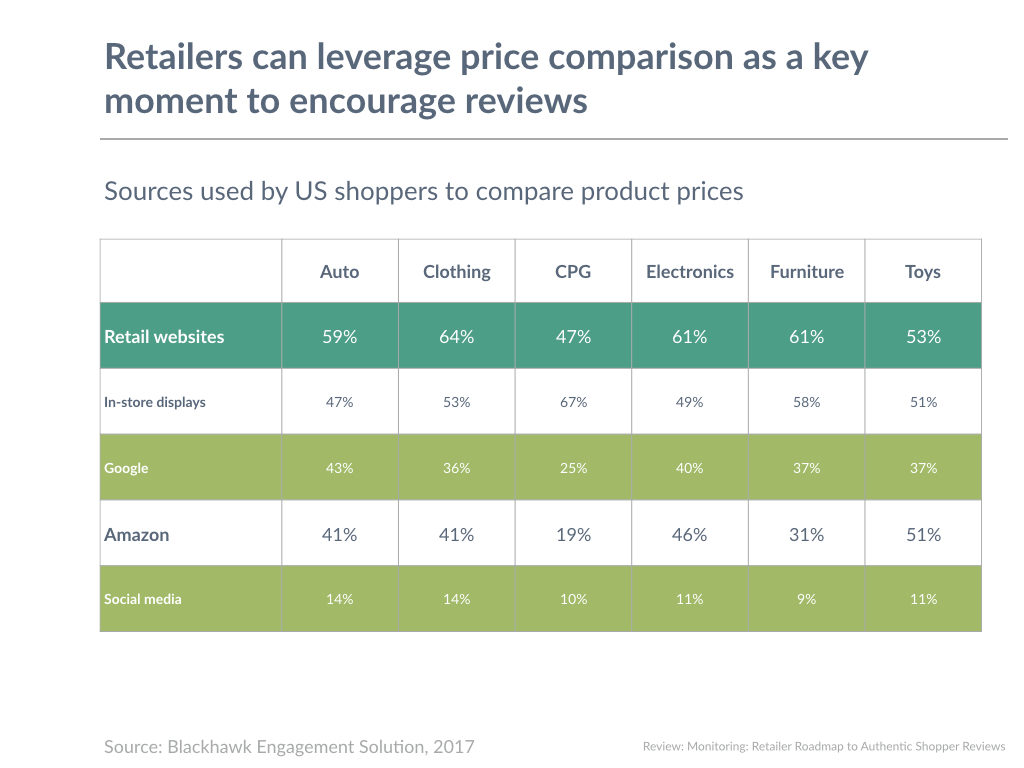

Retailers who seek to motivate consumers to post reviews on their website can adopt a two pronged approach in their strategy. Firstly, they can leverage price comparison during research as a key moment to re-engage shoppers for product reviews. Retailer websites are the top destinations for price comparison in clothing (64%), Electronics (61%) and Toys (53%). Amazon lags in price comparison behaviour across all categories. While a Consumer Packaged Goods buyer prefer to compare prices in physical stores, almost 1 in 2 (47%) compare prices on retailer websites well ahead of Amazon (19%). Price comparison is a key moment that shapes purchase decisions and is prevalent across categories. Retailers need to optimise shopper journeys from price comparison to purchase, and inviting them to post reviews across post-purchase moments.

Secondly, retailers can take a mobile-first approach to generating reviews on their websites and apps. Amazon is already the most downloaded shopping app and the first point of contact on mobile during the path to purchase. However, retailers have the upper hand when it comes to shoppers accessing mobile apps inside a store. More than 3 in 10 (31%) shoppers use the retailer’s app when in a store, compared to 1 in 4 who use the Amazon app. The physical store makes the retailer’s own app more relevant than Amazon.

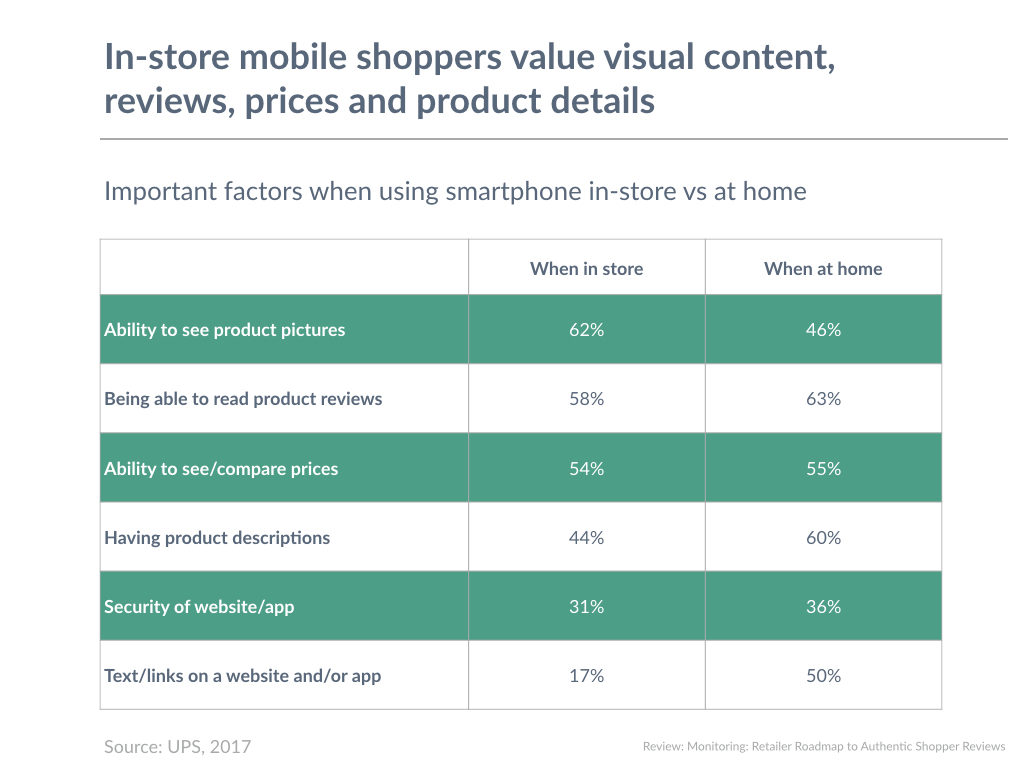

Retailers can provide a better mobile app experience in-store by focusing on things that shoppers care about when using smartphones inside a brick and mortar store. More than 3 in 5 (62%) prioritise being able to see the product picture as a visual confirmation that they are getting information on the product that is in front of them in the store. More than half of all in-store smartphone users want to be able to read product reviews (58%) as well as compare prices (54%). In comparison when shoppers use their mobile device at home, they prioritise reviews (63%),product descriptions (60%), and price comparison (55%). There is opportunity for retailers to personalise content based on shopper location when they open the app.

Reviews continue to be a key factor among in-store smartphone users. The top shopping related smartphone activity among in-store mobile users is to look up product reviews (29%) ahead of reading details (28%) and comparing prices (27%). Overall, retailer apps can leverage the in-store opportunity by providing the right content through their mobile apps in the form of mobile-friendly reviews, images, details, and prices to drive purchase. They can then invite the shopper to post a review back on the mobile app in an attempt to grow authentic reviews on their own websites and apps.

Amazon is removing commenting feature from product reviews